Independent aftermarket shops in Canada are in a firm second position when it comes overall market share in the Lube, Oil, Filter (LOF) service category, but there’s a stark difference in the gap to dealerships.

That’s according to the JD Power Canada Customer Service Index Long Term Study 2023, The study draws on more than 21,000 service occasions, Canadian drivers reporting where they brought their vehicles for service and what that service was.

In terms of LOF service occasions for, the gap to the number-one ranked Dealerships varies considerably by age category of vehicles.

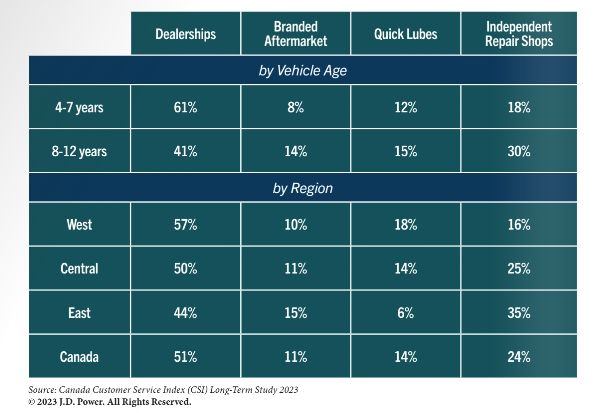

Nationally across Canada, for vehicles in the 4-to-7 year old range, Dealerships dominate with some 61% of the visits reported, while Independents are a distant second with 18%, ahead of Quick Lubes at 12% and Branded Aftermarket Outlets at 8%.

The picture is considerably better for all aftermarket players including Quick Lubes for the 8-to-12 year old vehicle category.

For these “older” vehicles, Dealership share of service occasions drops to 41%–a 20 point drop–with more than half going straight to Independents, and the bulk of the remainder (6%) going to Branded Aftermarket outlets while Quick Lubes picked up 3%.

Of coures, regionalism defines much of Canada’s identity–there are considerable differences in the options available to Canadian drivers depending on where they live.

So, while the Canadian national average service occasions in the LOF category earned by Independents stands at 24%, Western Canada Independents only earned 16% of LOF ocasions, while Eastern Canada Independents earned 35%. Central Canada Independents split the difference with 25%.

In fact, the picture of LOF service share paints a picture of a much more robust aftermarket landscape in the East–Ontario, Quebec, Maritimes and Atlantic–as compared to the West (B.C.) with, again, Centra (Alberta, Sask. Manitoba) splitting the difference.

The only aftermarket LOF player that excels in the West are the Quick Lube, with three times to share in the West (at 18%) as they enjoy in the East (at 6%).

Beyond the market share, there are some key trends to monitor.

From a product perspective, the grades and performance of engine oils continue to evolve and proliferate. A combination of changing automaker driven certifications have pushed their way onto the labels of many brands available to the aftermarket. Although this is not new, the pace of change and proliferation of options that it requires access to greater breadth of product. While the shift in grades is incremental, over the recent period the rise in lighter oils as a significant parts of the oil change market has been unmistakable. 0W16 grades would have been unheard, but are now becoming part of the standard offering.

And, while it is still early in the EV fluid market development, players are making their positions known by introducing products for this segment. Fluids specifically engineered for EV applications in transmissions, coolants, and greases are focused on efficiency and battery cooling are designed to maximize the performance and longevity of EV systems. While current sales volumes are low, the halo effect of showing “EV readiness” is not to be dismissed.

A second trend of note is the increasing interest of major players in the market in developing business and marketing programs to align with independent shops. Offering more than just outward signage—though offerings vary in both depth and breadth—it is unmistakable evidence that suppliers into this segment are looking to secure tighter connections with their service partners.

0 Comments