The aftermarket industry sector breakouts from Automotive Industries Association of Canada’s COVID-19 business survey, conducted April 20-May 8, 2020 and updated May 20, 2020, reveal a much more positive picture for the supply chain and mechanical repair sector than the overall data indicates.

Largely this was the result of breaking out the collision repair sector responses from the overall results – which made up about half the total respondents – and taking a closer look at the supply chain and mechanical repair sectors, respectively.

In all three sectors polled– supply chain, mechanical repair and collision repair – the majority of responses indicated that business was either very disrupted or slightly disrupted. However, each sector’s outlook on business drop as well as the path forward, are very different.

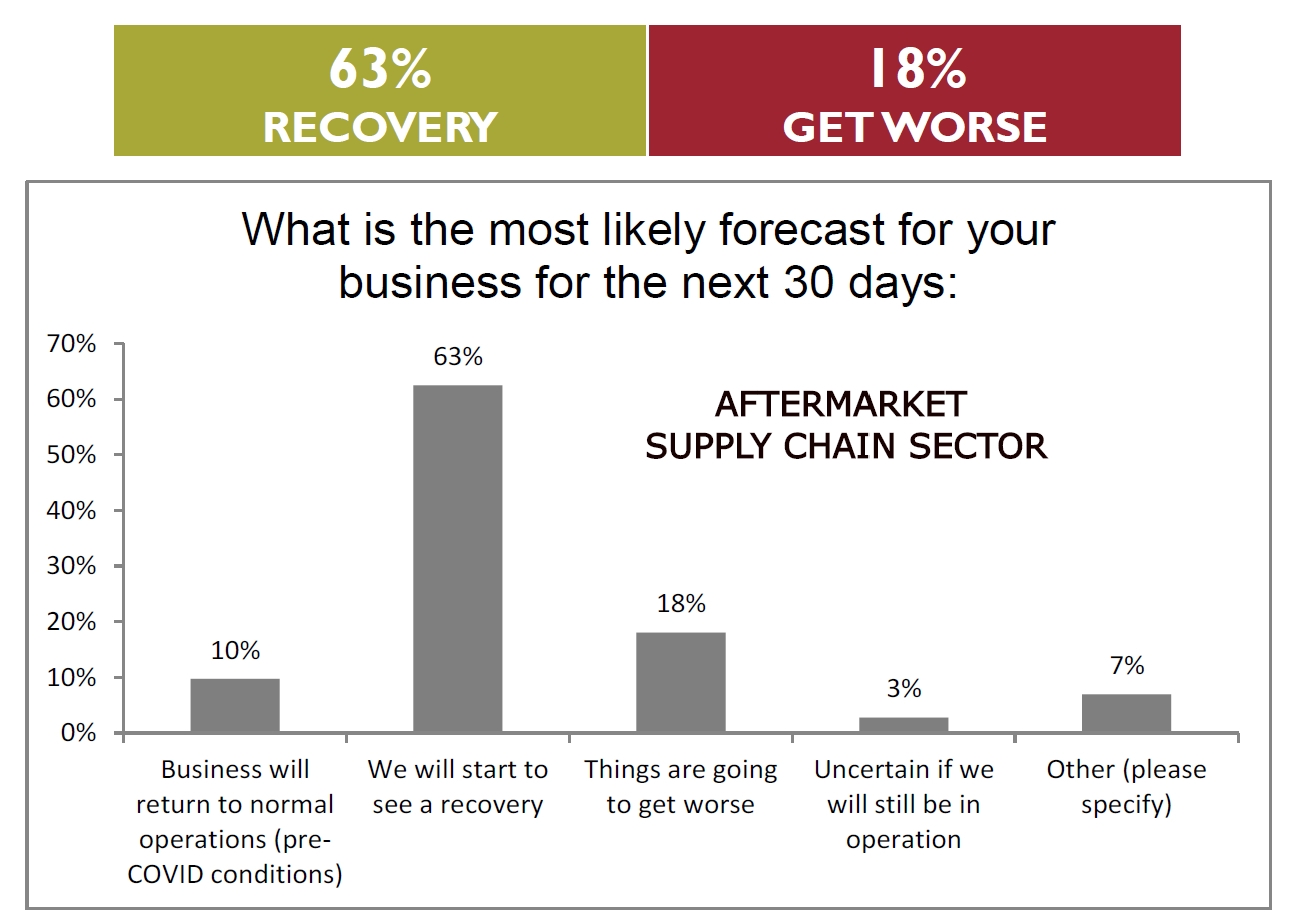

In the supply chain sector, 87% of respondents reported moderate to severe impact on revenues in April, with the highest number of responses (27%) indicating a revenue decrease of 21-30%. The responses for May indicated that the sector would continue to experience a revenue decrease of 11-20%, similar to the March 2020 period. While certainly of note, this contrasts markedly with a reduction of 30-40%, as indicated in the overall combined results.

However, perhaps the most stark difference on the supply chain side came from responses to the question polling respondents’ prospects for the next 30 days. (The survey ended on May 8.) Some 63% of supply chain respondents indicated they expected to see a recovery, and only 18% indicated that things might get worse. This was as high as 30% in the mechanical service sector results. Again, the overall indication of very disrupted to slightly disrupted was about the same as the overall survey results.

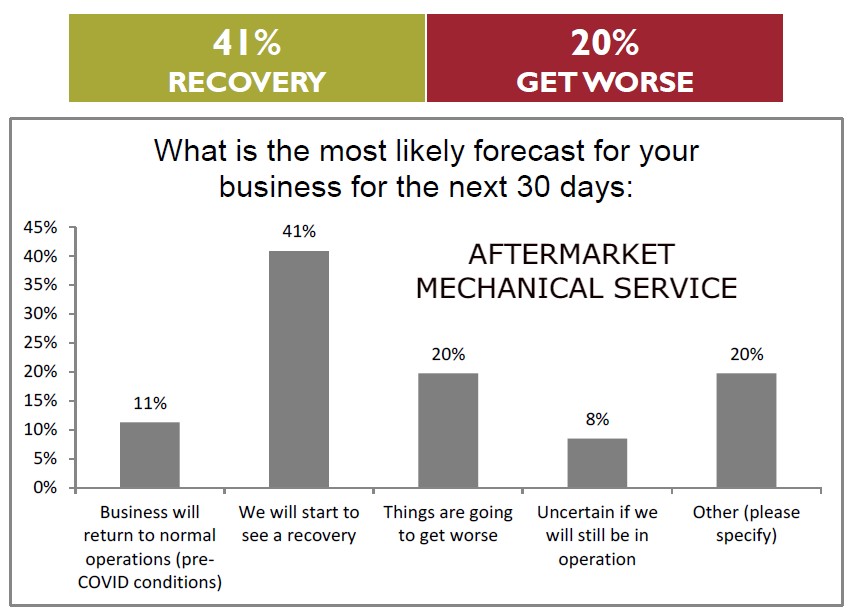

However, 26% of businesses reported a decrease in revenues, by 21-30% in March, while 39% indicated a loss of revenue by 50% or more in April. The forecast for May is highly uncertain, as 24% respondents expect revenue loss of 21-30%, while 21% of respondents continued to forecast a business decline of as much as 50%. They also appear to be less optimistic about the prospects for the next 30 days than the supply chain, with 41% predicting a recovery over the next 30 days and 20% suggesting things might get worse again.

Nonetheless, these are still better than the overall results would have indicated. As noted in earlier reporting on this survey, approximately one-half of respondents were from the collision repair sector, and that sector has certainly performed the worst over the last survey period.

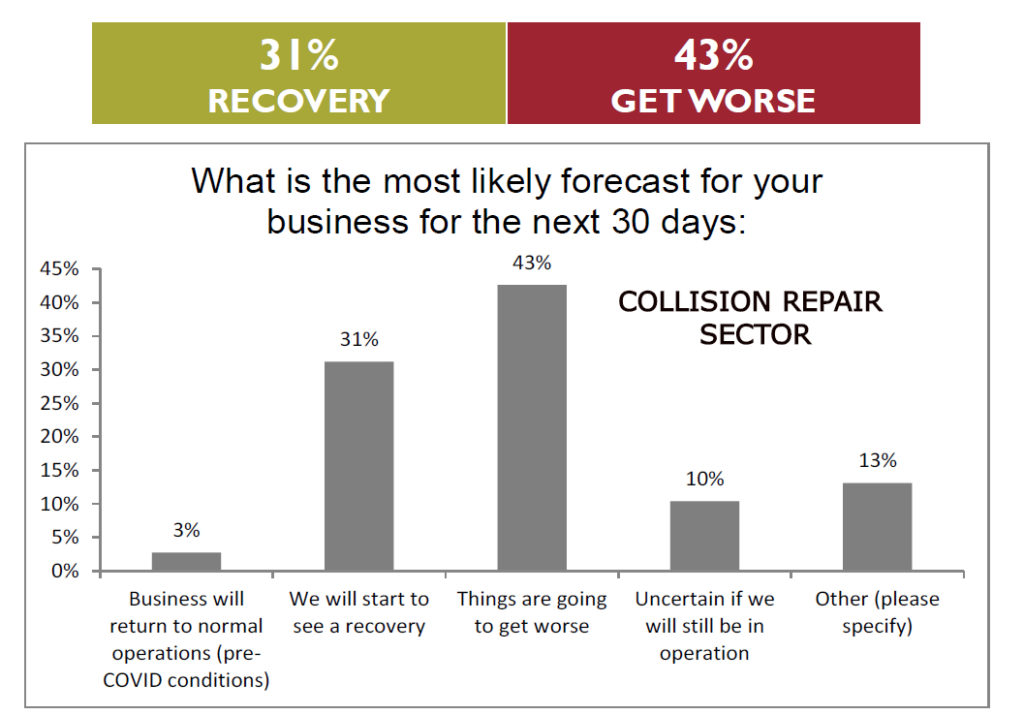

Interestingly, 21% of businesses in the collision repair sector reported no change in revenues in March, 2020, while April witnessed a sudden change in revenue patterns, with 43% of businesses reporting a revenue loss of 50% or more. Also standing in stark contrast to the more optimistic view is that the forecast for May indicates that 42% of respondents in the collision repair sector were forecasting a revenue loss of 50% or more, the highest of any sector period – not surprisingly, in lockstep with the previous collision repair sector responses.

The collision repair group is the least optimistic about the recovery period. Some 31% are looking to recovery over the 30 days following the survey period, with 43% saying that they will be faring worse over the next 30 days.

Looking back again at the mechanical sector, however, there is some room for optimism even beyond the actual numbers. The sentiments of those who had responded “business will increase,” “serve clients who spend more on their older vehicles as opposed to buying new ones”, and “are starting to see an increase in car count and cars on the road and hoping to see recovery, but every day something changes,” indicate a positive outlook.

A further update on this market survey is expected in June.

Visit www.aiacanada.com

0 Comments